WARNING: We’re going DEEP into real estate appraiser-geek-land!

A couple of articles ago, I looked at the relationship between housing affordability in Hawaii and The Aloha State’s median prices for single family homes and condominiums.

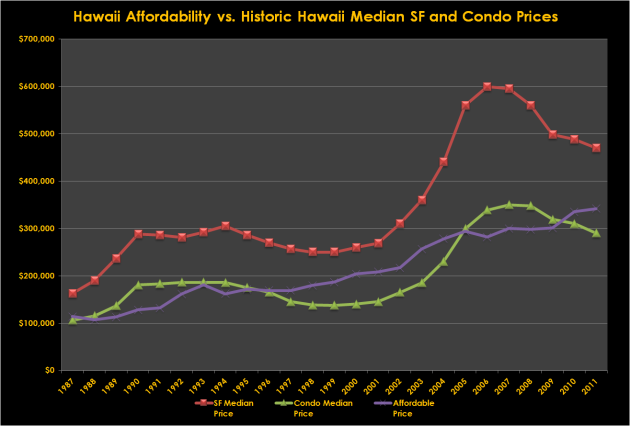

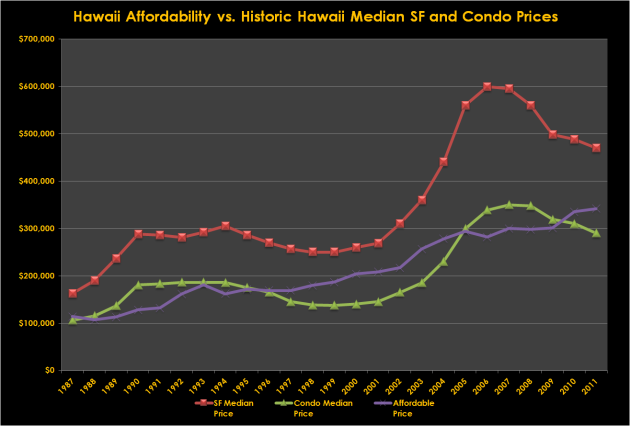

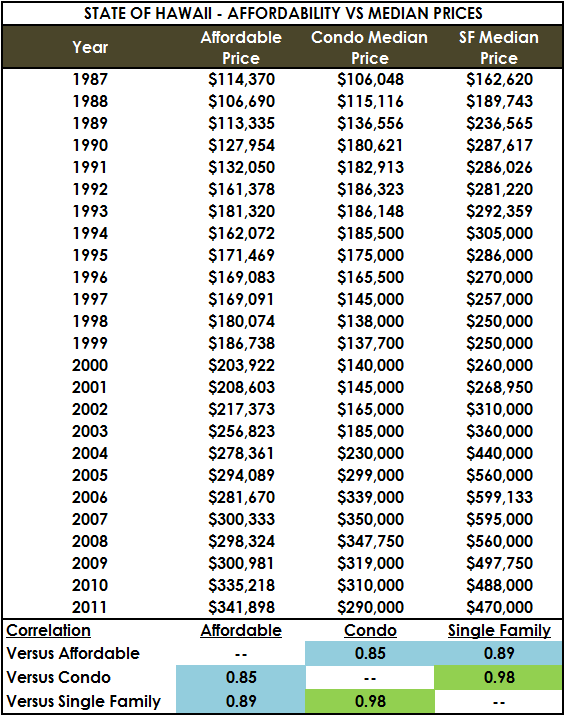

You might recall this chart, which compares Hawaii trends from 1987 through 2011:

The purpose of this article is to dig deeper into explaining how the affordable price trend, while obviously headed in the same general direction as Hawaii median price trends, does not necessarily correlate with them mathematically on a year to year basis.

As I said in my earlier post:

The red and green trendlines track single family and condominium prices in the study period–as shown, condos and single family home prices track pretty well.

How about affordability (the purple trendline) based on interest rates ?

The long term trend is clearly positive for all variables, with affordable price, condo price, and single family price all being about 3x higher in 2011 than they were in 1987.

But that’s not the question most folks are asking. The market participants I talk to are generally trying to answer the question “If interest rates go up (this year, or next year), will prices go down (this year, or next year)?” Is it a causal relationship?

What do you think? Personally, beyond long term growth, I don’t see a strong relationship in the data, and neither is a solid correlation revealed in geeky statistical analyses.

The people want to know: If interest rates go up (which means affordability goes down), does that mean prices go down?

I warned you, Hawaii real estate appraiser geek stuff:

Let’s just get this out of the way before I get a bunch of emails from anal appraisers: Correlation does not prove Causation. For a quick explanation of the difference, please consult one of my idols, Sal Khan.

Now that we all agree that correlation does not prove causation (just because healthy people eat breakfast doesn’t mean eating breakfast makes you healthy), let’s move on to the question of whether interest rate changes correlate with movement in Hawaii single family and condominium median prices.

Correlations, positive or negative, can be weak or strong.

Positive correlations are assigned a score between 0.00 and 1.00. A zero score (0.00) means there is no correlation (the weakest measure). A score of 1.00 is a perfect positive correlation (the strongest measure). As the correlation gets closer to 1.00, it is getting stronger. So, a correlation of 0.75 is stronger than 0.55, and a 0.35 is weaker than a 0.45.

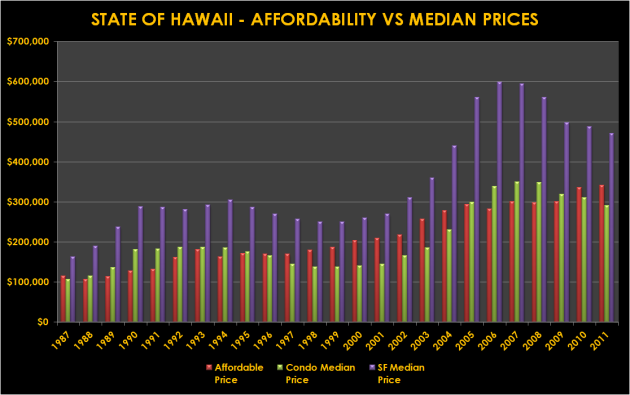

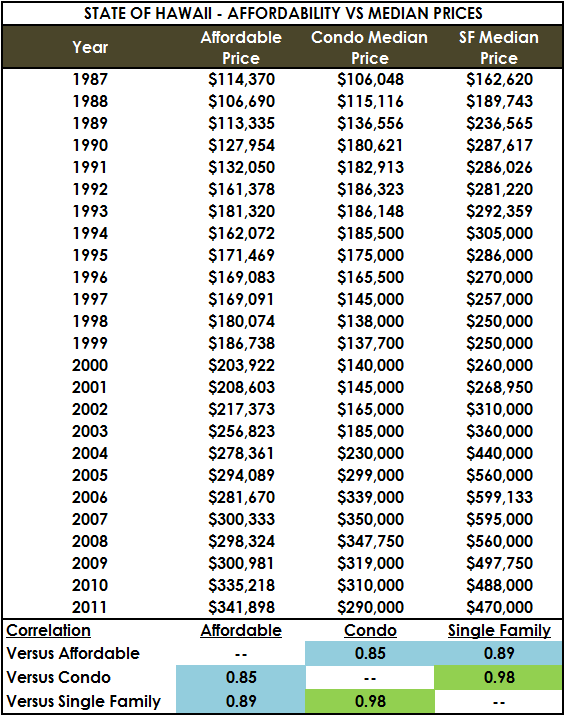

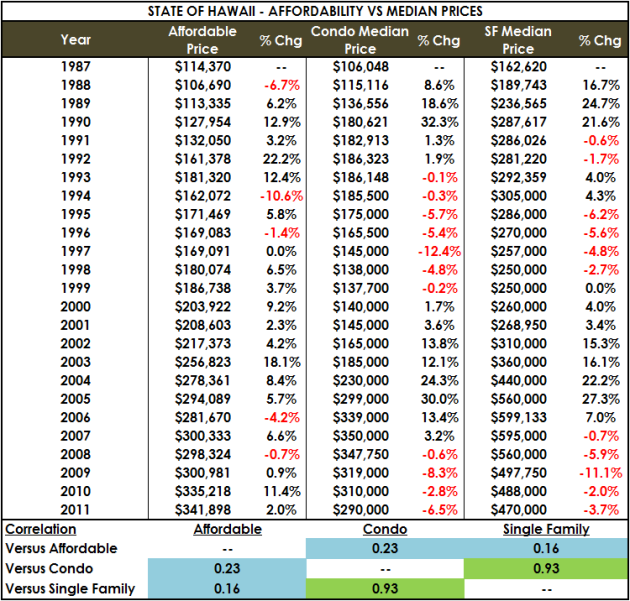

Let’s look at the raw numbers first:

As shown in the table and graph, affordability numbers, over the long haul, have a pretty good correlation with long term trends (highlighted in blue), scoring a 0.85 against condominium median prices and a 0.89 against single family median prices.

Pretty impressive! But easily trumped by the 0.98 score logged by condos against single family prices! (highlighted in green)

In this analysis, over the long term, affordability is absolutely heading in the same direction, and in a “kinda-sorta” similar magnitude, as median residential prices.

“But that’s not the question most folks are asking.”

How about my earlier idea, that what market participants really want to know is: “If interest rates go up (this year, or next year), will prices go down (this year, or next year)?” Is it a causal relationship?

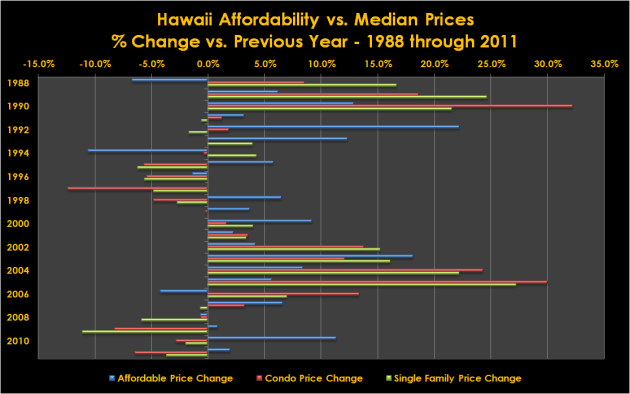

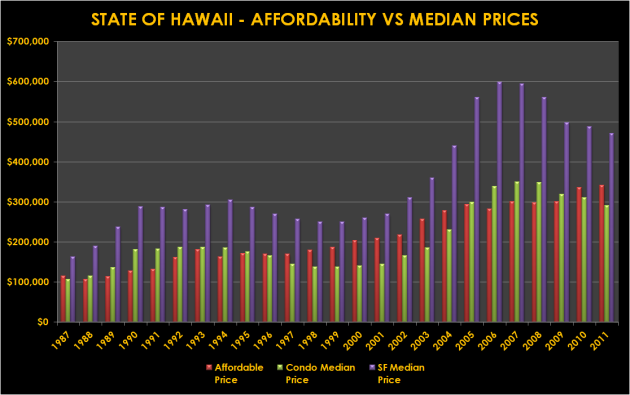

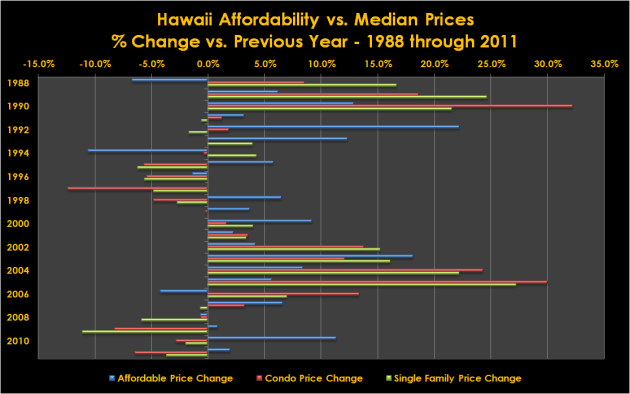

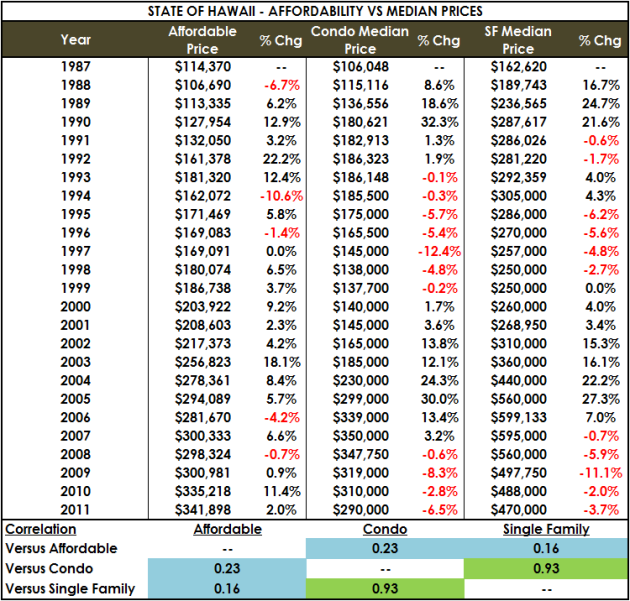

The way to test this question is shown below. How does the “year over year” percent change in affordability track with the same year’s percent change for residential product?

The blue lines don’t match so well with the red and green.

Take another look at the affordable versus condo/single family correlations. Not Pretty.

How about condo versus single family? Still going strong!

Conclusion?

There is absolutely no doubt that interest rates and overall home affordability head in the same “long term” direction as median prices. But if you are a real estate appraiser and are asked to opine on the idea of whether or not interest rates/affordability track with median prices, think carefully before knee-jerking your response. I say “not so much”, at least in Hawaii.

Questions, comments? Please leave them in the comment box below, I would be honored to clarify and/or expand.

Aloha, Chris

Recent Comments