Hawaii Four Seasons Hotels – A resort real estate appraiser’s friend when data is tough.

August 13, 2013 1 Comment

Imagine you’re an appraiser in Hawaii, and you’re given the enviable task of appraising an oceanfront homesite in the Manele Resort on Larry Ellison’s island of Lanai.

There are only eleven oceanfront lots currently developed in the resort (as shown roughly in the aerial below) and only one lot has sold in the last decade (Lot 130, for $3,612,500 in May 2011):

The sale of Lot 130 is a godsend, but other than that, what is an appraiser to do for comps?

We can’t very well do a one comparable appraisal: We’ve got to go off island.

Two resort areas of the State of Hawaii that are similar to Manele Bay in terms of climate and resort appeal are Wailea (Maui) and Hualalai (Big Island). All three neighborhoods have oceanfront homesites that could potentially provide sale comparables, and all three master planned communities are home to a prestigious Four Seasons resort!

What gives? Being (arguably I’m sure) the most prestigious hotel operator (“flag”) in the State of Hawaii, Four Seasons resort properties must meet certain strict criteria in order to qualify as a potential member of the brand. Each of the three resorts on Lanai (Manele), Maui (Wailea), and the Big Island (Hualalai) are world class hotels that were constructed between 1989 and 1996, and have been well maintained in the interim. As such, the physical plant of each resort should have reasonably similar cost/value attributes. (The Hualalai resort is a newer “bungalow-style” design that likely has more market appeal)

Under the assumption that each of the three properties benefit from first class or better improvements, differences in room rates likely capture a good portion of the market’s preference for a specific location/resort. For an appraiser starved for data in a highly-unique sub-market like Manele Bay/Lanai, hotel room rates can provide much needed market support for potential location adjustments.

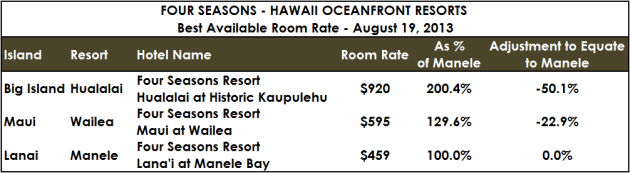

Consider the following:

| FOUR SEASONS – HAWAII OCEANFRONT RESORTS | ||||

| Best Available Room Rate – August 19, 2013 | ||||

| Island | Resort | Hotel Name | Year Built | Room Rate |

| Big Island | Hualalai | Four Seasons Resort Hualalai at Historic Kaupulehu |

1996 | $920 |

| Maui | Wailea | Four Seasons Resort Maui at Wailea |

1989 | $595 |

| Lanai | Manele | Four Seasons Resort Lana’i at Manele Bay |

1989 | $459 |

That’s right, the best available room rate at the Four Seasons Hualalai is DOUBLE the same at Manele Bay!

The following chart shows the relationship of each hotel to its Manele cousin, and the indicated adjustment to equate each room rate to Manele:

Source: http://www.fourseasons.com/

Downward appraisal adjustments of 23 percent (Wailea) are serious business, never mind 50 percent allowances (Hualalai). But for the appraiser who is digging deep for market support for a location adjustment, comparative hotel room rates are an interesting value indicator to consider. In a future article I’ll examine the three neighbor island resorts in greater detail and see if these price relationships hold.

Questions, comments? Please leave them in the comment box, I would be honored to clarify and/or expand.

Aloha, Chris

Pingback: Hawaii Four Seasons Hotels – A resort real estate appraiser’s friend … | BLUME BOSTON GROUP